November 8, 2025

Article

A Quick Prediction Markets Overview: What Are They? How Do They Work?

Learn the basics of prediction markets: What are they? How do they work? Price = Probability? And more…

Imagine being able to trade on real-world events like "Will the economy enter a recession in 2026?" or "What will be the highest temperature in Denver, CO today?"—with real money, and at the market fair value price. That's the power of prediction markets: platforms that turn forecasts into tradable assets. If you're new to this space, this primer will break it down simply, helping you understand the basics and get started.

Table of Contents

What Are Prediction Markets?

How Do Prediction Markets Work?

Market Structure and Pricing

Key Players: Kalshi and Polymarket

Fees Explained

History and Evolution

Benefits and Use Cases

Risks and Responsible Trading

How to Get Started

FAQs

Conclusion

What Are Prediction Markets?

Prediction markets are online platforms where anyone can buy and sell contracts related to the outcomes of future events. These are called “event contracts” which payout based on Yes/No questions about real world events. These ae much mor ethan mere gambles, but are being used to harness the power of markets to establish probabilities more accurately than traditional polls or experts.

Some examples of markets might be:

Will CPI inflation exceed 3% in December 2026? (Yes/No)

Will the New York Yankees win the 2026 World Series? (Yes/No)

Will a major tech company release a new AI product by mid-2027? (Yes/No)

How Do Prediction Markets Work?

Anyone can propose markets, but they must be verified by the platform's market team to ensure fairness and define clear rules.

Components of a market:

Clear Underlying Event:

The question must have an objective, verifiable result.

No subjective opinions allowed—like "Is this the best movie ever?" Instead, they stick to measurable facts, e.g., "Will total snowfall in NYC exceed 10 inches on January 5th?"

Source Agency:

A trusted third-party source determines the outcome.

Examples include the Bureau of Labor Statistics (BLS) for economic data, National Weather Service (NWS) for weather, or official sports leagues for game results.

Clear Payout Criteria:

Rules specify exactly what triggers a Yes or No payout.

For instance, "Yes pays $1 if CPI > 3%; otherwise, No pays $1."

Fixed Expiration Date:

Markets close at a set time, and if unresolved at that time the market defaults to No.

Example: December 31, 2026, 11:59 PM ET.

Review Process:

For Kalshi, ideas must pass their internal review: CFTC-compliant, not easy to manipulate, and in users’ interest. If a proposed market fails this they won’t list it

To read more about Kalshi’s criterion for markets check this link.

Once approved, trading begins. Prices fluctuate based on supply and demand, reflecting the market's estimated probability (e.g., a $0.60 Yes price implies a 60% chance).

Market Structure and Pricing

Prediction markets use a simple payout system: Contracts resolve to $1 for the winner and $0 for the loser. These resolutions bound the trading prices for contracts to a range between 0 and 1. Why? Who would buy a yes contract for $1.2 if the max value a contract can reach at resolution is $1. To make this clear let’s consider the following market:

"Will the Kansas City Chiefs win the 2026 Super Bowl?"

Yes contract: Pays $1 if they win, $0 if they lose.

No contract: Pays $1 if they lose, $0 if they win.

Current prices: Yes at $0.15, No at $0.85.

If you buy 1 Yes contract for $0.15 and they win:

You receive $0.85 (profit) + $0.15 (your initial cost) = $1 (your payout at resolution)

The seller of Yes (effectively buying No) loses their $0.85.

Side | Entry Price | Outcome = Yes | Outcome = No |

Buy Yes | $0.15 | $1.00 | $0.00 |

Buy No | $0.85 | $0.00 | $1.00 |

Important to note:

Platforms hold $1 per Yes/No pair to distribute at resolution.

Trade anytime—no blackouts, even during events.

Yes + No prices sum to $1 (otherwise you have an opportunity for arbitrage).

Max loss is limited to your entry price

Prices act like probabilities: A $0.15 Yes means the market sees a 15% chance.

Key Players: Kalshi and Polymarket

The biggest platforms by volume are Kalshi and Polymarket. In October alone, they reported over $8.5B in combined notional volume. This was the largest month on record and shows their high adoption recently. Both companies vary significantly, so we’ve made an entire article about that, if interested check it out link.

Platform | Regulation | Key Features | Fees Model | Best For |

Kalshi | CFTC-regulated as a DCM (U.S. legal) | Fiat currency, user-proposed markets, easy interface | Maker/Taker | Beginners, U.S. users |

Polymarket | Blockchain-based, not operating in the US | Crypto settlements, decentralized, global access | Flat transaction fees | Crypto users, anonymity-focused traders |

The largest differentiator is that Kalshi is a CFTC regulated Designated Contract Market (DCM) whereas Polymarket is chain based and has not launched in the US yet.

Fees Explained

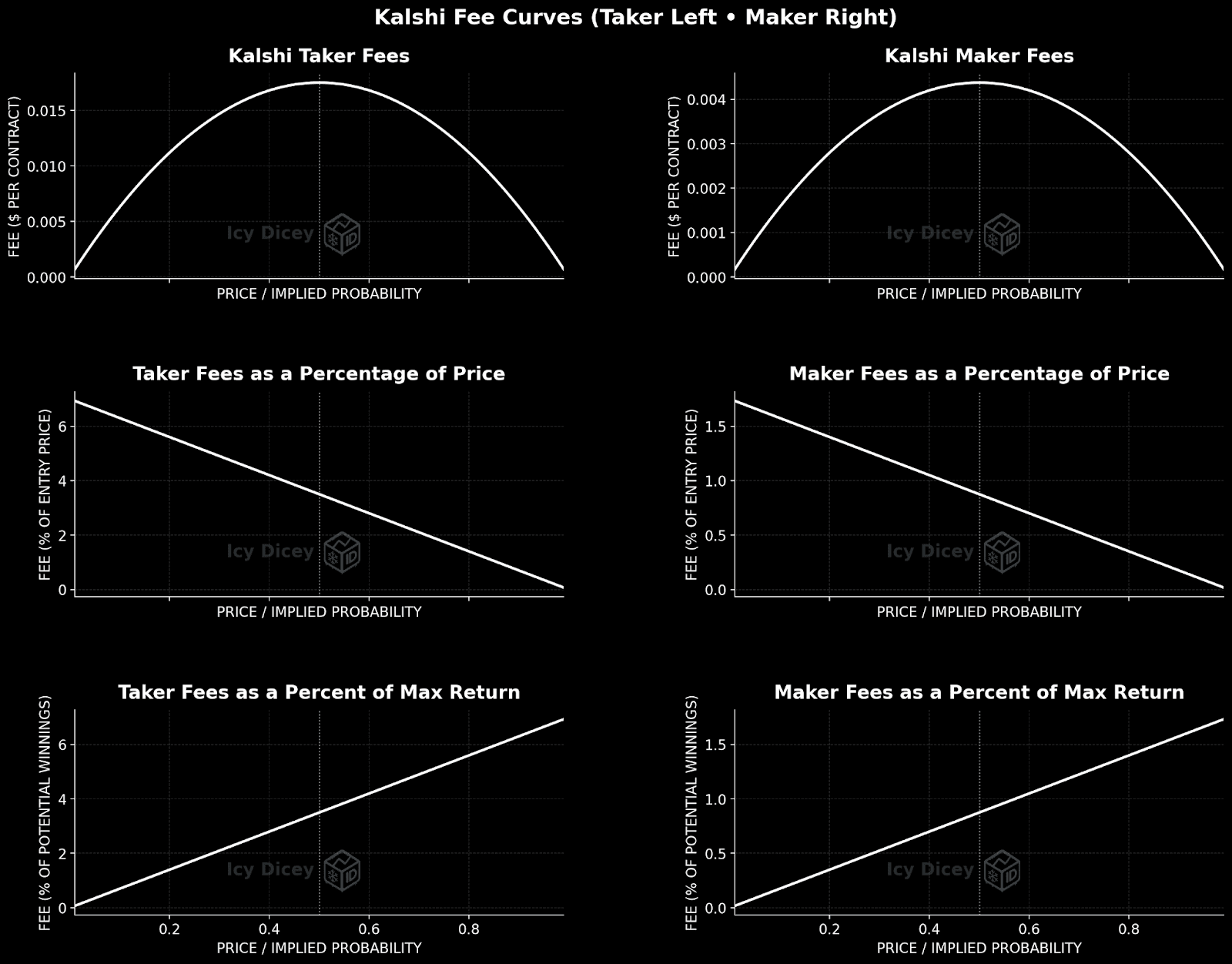

Fees can seem complex but are based on trade size and risk. Kalshi uses a maker/taker model:

Taker Fees (applied to market orders): Rounded up(0.07 × C × P × (1−P)), where C = contracts, P = price.

Maker Fees (limit orders that add liquidity): Rounded up(0.0175 × C × P × (1−P)).

This structure charges more for mid-range prices (around $0.50), and less nominally for tail prices. Polymarket typically uses flat fees (e.g., 0.5-1% per trade).

If that sounds complicated, it is. Here are graphs to help visualize them:

Polymarket, launching in the US soon is going to be offering a flat fee of .01%, drastically different from Kalshi. Clearly this is meant to be a jab at Klashi, whose fees range from 1 percent to over 7 percent of price. It will be interesting to see if Kalshi ends up changing their fee structure based on this development.

History and Evolution

Prediction markets have a history that actually goes back to the 19th century. Prediction markets as we know them today came about in the 1980s with the Iowa Electronic Market (IEM) used for academic research. Today, technology advancements like blockchain (Polymarket) and laxing regulation (Kalshi) have fueled growth, turning them into multi-billion-dollar ecosystems.

Why prediction markets?

Accurate Forecasting: Something interesting happens when people put their money on the line: they bet correctly. For this reason these markets outperform polls and pundits, who do not put anything on the line. More on this in the future, but for now understand that price = probability

Hedging Risks: Prediction markets now allow risk to be transferred on literally any event. Take for example a city government that has a team going to a sports championship. If the cities team wins, then the city government will need to pay for a parade. So, the city government then buys protection by betting on their team winning.

More efficient betting: If you do so use the prediction markets as entertainment, they are a much more efficient way to bet on events than say on sports books. Sport books offer their own money lines and have blackout period. In prediction markets, you’re betting against the market, thus you enter at better prices and have the freedom to trade in and out as many times as you’d like.

Real-World Impact: Since the odds on prediction markets are so accurate, people are beginning to use them to anticipate things happening before they do. Take for example a future pandemic, the prediction markets might show higher odds of it spreading, and thus specialists and policymakers can take appropriate risks.

Conclusion

Prediction markets democratize forecasting, blending finance, data, and human insight. With booming volumes and evolving tech, they're more accessible than ever. Dive in responsibly, and who knows—you might predict the next big thing.

We’re building a platform to give you real edge. Stay tuned as we post about how to rig the markets in your favor to create long term wealth in these markets.